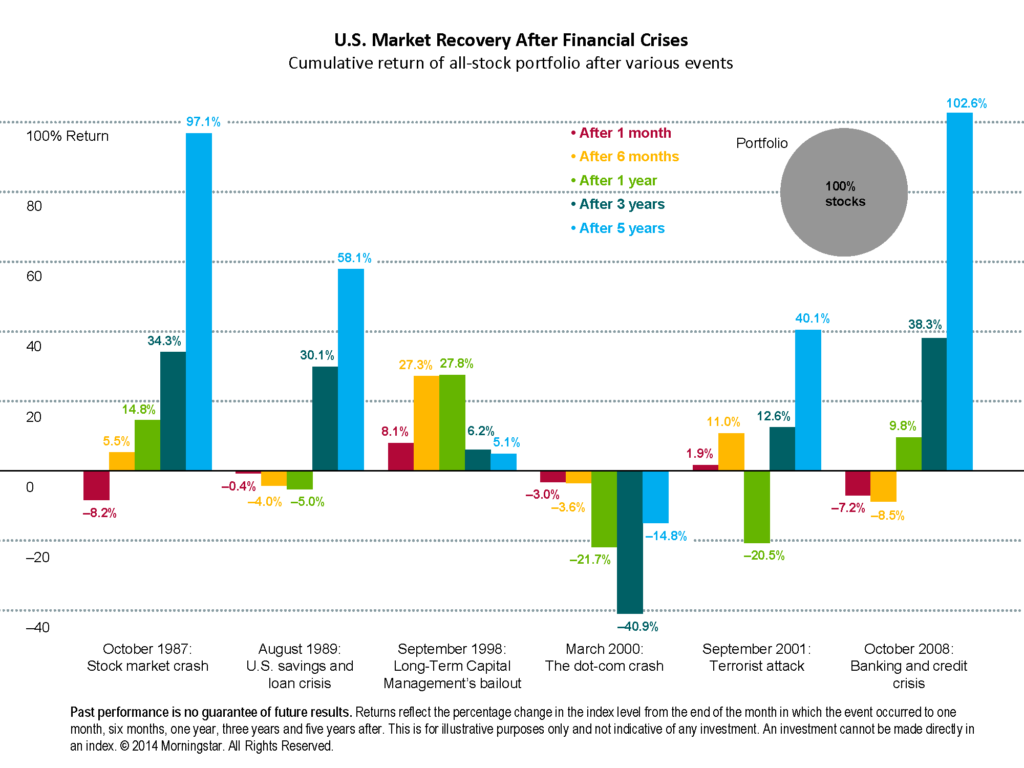

U.S. Market Recovery After Financial Crises: All-Stock Portfolio

Stock prices suffer during financial crises, but they typically recover over time.

This image illustrates the cumulative returns of an all-stock portfolio after six historical U.S. financial crises. In the short term, uncertainty from such external shocks can create sudden drops in value. For example, the all-stock portfolio posted a negative return in the month following four of the six analyzed crises. Over longer periods of time, however, returns were much more attractive, and investors who stayed the course reaped considerable rewards.

Fear and uncertainty might lead investors to sell their investments during tough times, putting downward pressure on prices. Trading because of these emotions can be detrimental to a portfolio’s value. By selling during downward price pressures, investors might realize short-term losses. Furthermore, this is compounded as investors wait and hesitate to get back into the market, possibly missing some or all of the potential recovery. The lesson here is that patience can pay dividends.

Returns and principal invested in stocks are not guaranteed.

About the data

Stocks are represented by the Standard & Poor’s 500®, which is an unmanaged group of securities and considered to be representative of the U.S. stock market in general. Calculations are based on monthly data. Data assumes reinvestment of all income and does not account for taxes or transaction costs. For the U.S. savings and loan crisis, August 1989 was chosen because that was the month the Financial Institutions Reform, Recovery and Enforcement Act of 1989 was signed into law. For Long-Term Capital Management, September 1998 was chosen because that was the month the hedge fund was bailed out by various financial institutions. For the banking and credit crisis, October 2008 was chosen because that was the month the Emergency Economic Stabilization Act was signed into law.