Morrison’s Money Minute

October 2016

When we think of October we think of Halloween, of course. I mean, what’s more scary than goblins, witches, ghosts, power rangers & ninja turtles running around our neighborhoods after dark? Well historically, October has occasionally been a scary month for the stock market too, most memorably, October 19, 1987, when the US large stock market lost approximately 28% in four hours.

What we typically expect during Halloween is a Trick-or-Treat. I want us to also expect that the markets (during any month actually) will retreat, or drop, and then recover and excel; the sole variable being by how much and over what time period(s).

Since few of us like surprises within our investment portfolios, let’s erase the (largely subconscious) notion that a stock market correction is a reason to panic and sell. Instead, let’s remember that the markets both ebb & flow, and if we stay invested through both, history will likely repeat itself and reward us with handsome increases.

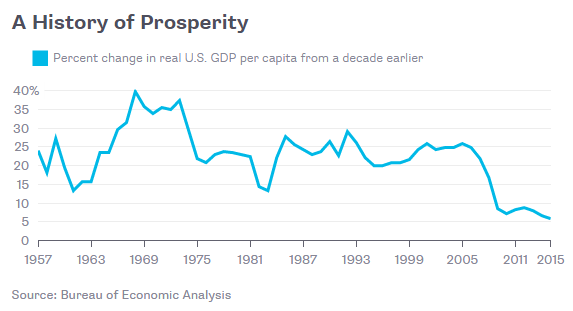

Here is a chart depicting the drops in stock market performance immediately following several major world events alongside the percentage of recovery after the stated periods of time. As you can see, markets have bounced back after what most of us would call ‘significant events.’ So also in normal market drops. Historically every drop in the markets from the great Depression through 2009 has been followed by an even higher high.

So how can we alleviate feeling fearful about our stock market investments or our portfolios, especially during the month of October? Easy; we frame these temporary downturns as just that, temporary price reductions, that invite additional investing if we have extra cash. They are NOT a clarion call to sell!

Call us today to perform a quick analysis of whether your portfolio is best suited for the next downturn.

To your Empowerment & a Happy Halloween!

[div class=”content-2-col-left”]

Presidential Elections and Stock Market Returns

By Dana Anspach

Past election years have seen more positive results than negative…

Read More

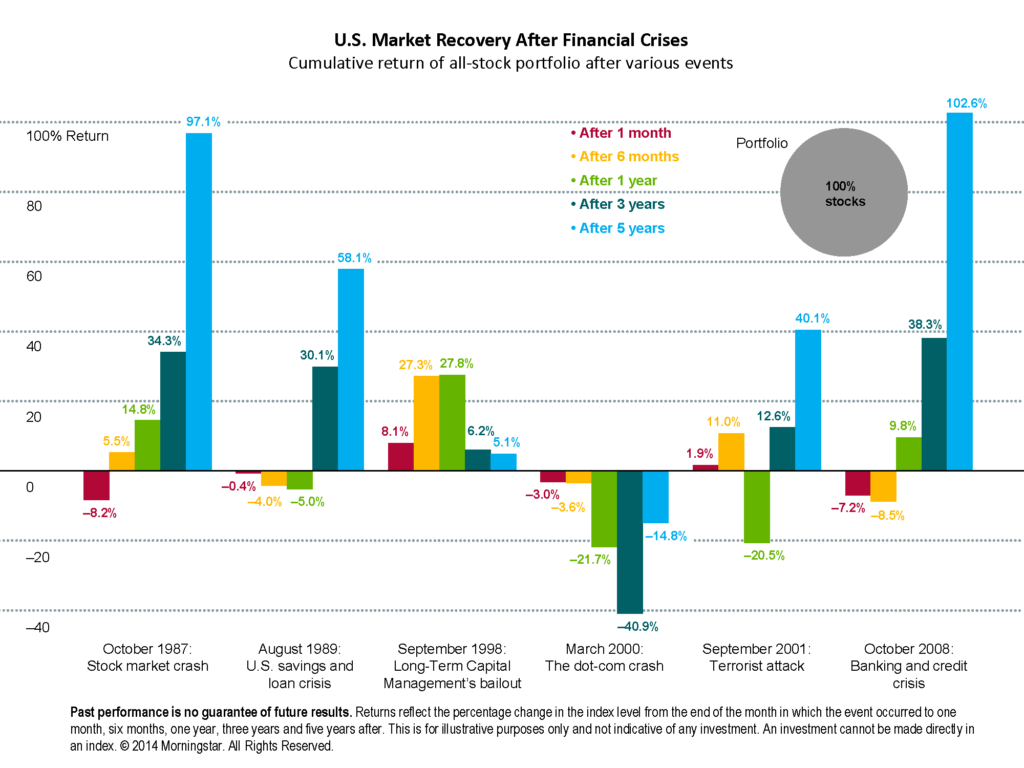

Why Americans Feel Poor in One Chart

By Narayana Kocherlakota

Why do so many Americans feel dissatisfied about the economic state of their nation? One simple chart offers a lot of insight…

Read More

Read More

HISTORY OF STOCK MARKET RECOVERIES AFTER MAJOR WORLD EVENTS

U.S. Market Recovery After Financial Crises: All-Stock Portfolio

Stock prices suffer during financial crises, but they typically recover over time.

This image illustrates the cumulative returns of an all-stock portfolio after six historical U.S. financial crises. In the short term, uncertainty from such external shocks can create sudden drops in value. For example, the all-stock portfolio posted a negative return in the month following four of the six analyzed crises. Over longer periods of time, however, returns were much more attractive, and investors who stayed the course reaped considerable rewards.

Fear and uncertainty might lead investors to sell their investments during tough times, putting downward pressure on prices. Trading because of these emotions can be detrimental to a portfolio’s value. By selling during downward price pressures, investors might realize short-term losses. Furthermore, this is compounded as investors wait and hesitate to get back into the market, possibly missing some or all of the potential recovery. The lesson here is that patience can pay dividends.

Returns and principal invested in stocks are not guaranteed.

Click Here to Read Full Article

The word “crisis” in Chinese is composed of two characters: the first, the symbol of danger; the second, opportunity.

– Anonymous

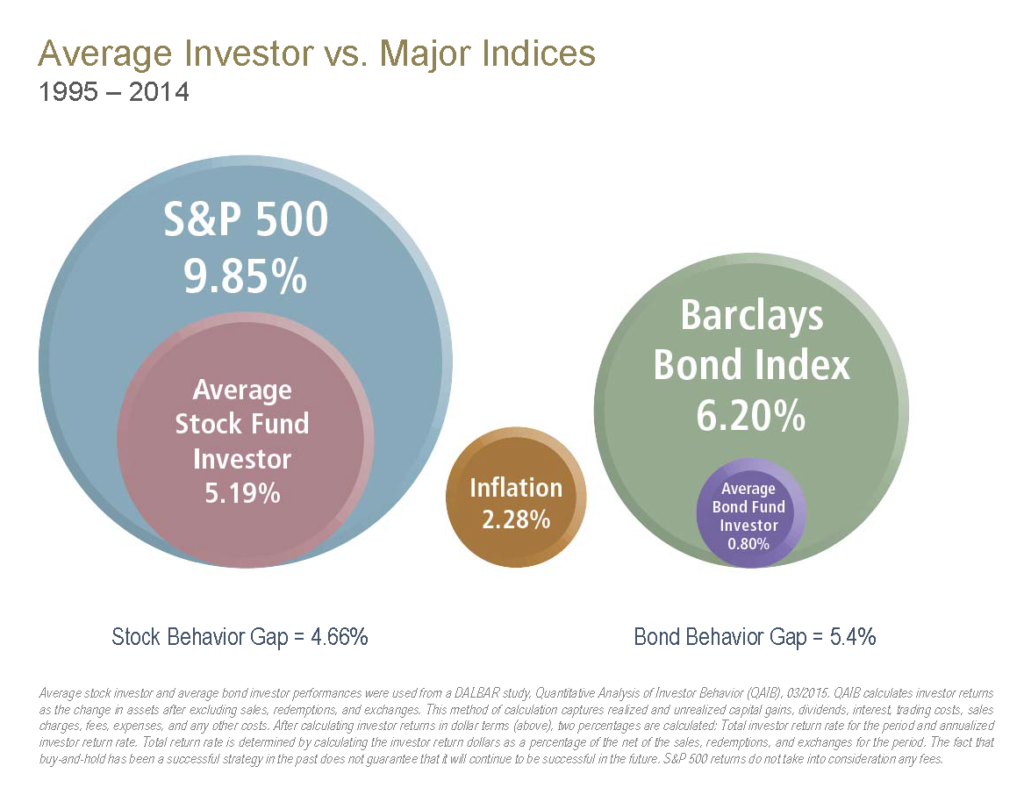

Just GET the Market

Why the difference you ask? When investors panic upon hearing/seeing the media overreact to normal (or even paranormal) market price gyration, and SELL their investments, they lack the strategy, the discipline to know when to buy again. Since the ‘sudden sale’ was largely emotional, so also, emotions keep investors on the sidelines until there’s sufficient ‘proof’ that it’s “safe” to get back in. That measurement of “safe” is often a sizeable uptick in market performance; 5, 10%, whatever, that this same sidelined investor MISSED by not having remained invested in the markets.

These days, market volatility is to be expected, and huge swings in prices (while alarming) are nonetheless NOTHING the average investor wants to attempt to “time”; so stay the course that you’ve devised—hopefully with the wise guidance of a Fee-Only CFP®–and ultimately while I can’t predict future performance, the history of the markets’ returns gives me confidence that if history either repeats itself, or rhymes, most people will earn sufficient returns to meet the bulk of their goals.

WHEN TO CONSULT A FEE-ONLY CERTIFIED FINANCIAL PLANNER™

WHEN TO CONSULT A FEE-ONLY CERTIFIED FINANCIAL PLANNER™

When people don’t know what they don’t know, it may well feel difficult to discern when to consult a CERTIFIED FINANCIAL PLANNER™. Typically folks approach a challenge thinking there may only be 2 options…so they choose one option that appears either best, (or less damaging) to them. Absent knowledge to the contrary, they may be making an acceptable or even good choice, OR perhaps a very expensive choice…

Click Here to Read Full Article

Want to receive this useful and informative FREE newsletter directly to your Inbox each month? Click Here to Subscribe now so you don’t miss even one issue!

[/div]

[div class=”content-2-col-right”]

In this issue…

- Presidential Elections Effects on the Stock Market

- Why Americans Feel Poor…

- When to Consult a Fee-Only Financial Planner

- What Retirees Need to Know About Medicare

- …and more!

And don’t miss Debra’s Updated Dictionary of Useful Financial Terms!

We know you’re busy…

…and “financese” can be confusing. Why not let Debra save you valuable time by sorting through the noise for you?

Buy a stock the way you would buy a house. Understand and like it such that you’d be content to own it in the absence of any market. – Warren Buffet

What Retirees Must Know About Medicare Advantage Plans

From Kiplinger’s Retirement Report, September 2016

Read More

Buy the mini-book!

Now that you know when to consult a financial advisor,

let’s review what type of advisor you should hire

Thankfully, within the arena of financial planners, how the planner is paid actually serves as a valuable tool in helping you make that decision. Yes, it really is that simple. The three types of compensation amongst financial representatives, advisors and planners follow:

- Commissionable: earn product commissions, period.

- Fee-Based: charge a fee on a written plan (which not so surprisingly often recommends a life insurance or annuity product) PLUS earn commissions on products purchased.

- Fee-Only: charge a fee for their advice, period. This fee is typically either a flat annual amount or it is based upon a percentage of the assets they manage for you.

Fee-Only financial planners avoid the direct conflict of interest that the other two pose. Fee-Only financial planners operate under, and are professionally held to, a fiduciary oath of serving the client needs FIRST and foremost.

~Debra L. Morrison, CFP®, MS, AEP

[/div]